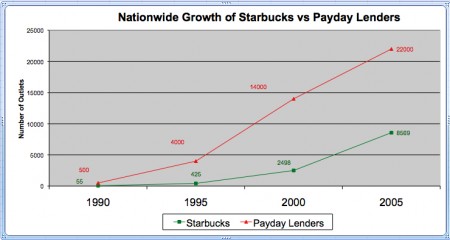

Yesterday I heard a terrific presentation from Kevin Volpp, a University of Pennsylvania economist and physician who studies, among other things, how techniques from behavioral economics can nudge people into healthier behaviors. In his talk, to demonstrate how prevalent economically irrational behavior is, he showed a chart comparing growth in Starbucks outlets versus growth in payday lenders.

With the help of Mr. Google, I found the source of the data, which comes from Steven Graves at Cal State-Northridge. Take a look at his chart below. Are you as surprised as I am?

Everyone repeat after me:

“Correlation does not imply causation. Correlation does not imply causation. Correlation does not imply causation. Correlation does not imply causation.”

Nevertheless, it is interesting. 🙂

http://xkcd.com/552/

@simon —

that xkcd cartoon is one of my all-time favorites. everyone click that link please.

but this chart wasn’t meant to show a causal relationship. it demonstrates something else: we all think that Starbucks are ubiquitous — but they’re nothing compared to payday lenders.

cheers,

dan

Ooooh, I get it. Proving the point that I should think more before a speak, or just remain silent. 🙂

Thanks for the clarification!

Wouldn’t a better comparison be all coffee chains versus all payday lenders?

Well, coffee has always been legal. Payday lending was only legalized in 1996 (at least according to your ehow link).

Is it possible that the ubiquity of Starbucks vs Payday lenders depends on the neighborhood you live in. Is it possible that people on the TED circuit will tend to think Starbucks as the ever-present overpriced addiction. People who live in neighborhoods where the only accessible grocery store is 7-11 will tend to see more Paydays. It would be interesting to see the geographic distribution of the chains compared to average income.

Interesting, however when taking competitors of Starbucks also into account wouldn’t the growth of coffee shops beat the growth of payday lenders?

I’m not sure I get it… Are you saying that both starbucks and payday lenders are examples of “economically irrational behavior” (in the customers) and that both are on the rise?

yes, I agree with mikew

Could this chart be confirming that rich are getting richer, while poor are getting poorer?

I detect a business opportunity for Starbucks payday lender. Actually, it would be payday lender Starbucks, to mirror the flow of the money.

Ahh, the American way… Capitalize on the fact that most of us live above our means.

I read this the same as Onder above; the class divide is increasing.

Or perhaps it means nothing; our population is also increasing. Starbucks at least has the driving force of a physically addictive product.

@Simon Foust, actually your conclusion was not wrong based on the accompanying text provided by Dan. I can’t tell from looking at the chart that it is trying to show the ubiquity of starbucks and payday lenders (even after reading Dan’s comment). A better chart would show the number / sq mile of these payday lenders compared to mcdonald’s, starbucks and uh, 7-Elevens, if one must pick specific store chains instead of broad categories.

@mikew, @jonatan, @artk, and others — you’re right. a better comparison would be category versus category rather than category versus example from a category. excellent point.

@caspar — yep. this is largely about class, though starbucks has become so ubiquitous it reaches well into the socioeconomic distribution, at least in the u.s. a geographic distribution would be fascinating.

@laurie — the economically irrational behavior kevin volpp was referring to was paying exorbitant interest rates — for instance, APR’s that reach 400 and 500%.

all — great comments. keep ’em coming.

What I found interesting, if I read the chart correctly, is that I have been aware of the growth of Starbucks for years, because I frequent them.

Not as much as my wife who has a GOLD card. But I really couldn’t even tell you where a Payday Lender is…didn’t really know they were that popular and plentiful. Are they like legal loan sharks? How sad for all those people who must frequent them.

This is a stark revelation. As much as the beverage may correlate with payday loans, it could signify risktaking and not just reckless behavior.

It would be interesting to see other dimensions like increase in average pay, fitness index and indices like creativity and participation.( how many new blog, publications appeared in this timeline) how many were on new topic, and had a decent contribution from others.

I am simply trying to correlate outputs like productivity, creativity, connectivity to the same base principle, and see if that makes a difference.

The visual presentation of data is tricky business. I think you’re being seduced by a purty picture. Consider this spin: in 1995, there were 10x the payday lenders compared to Starbucks; in 2000, 5.6x; in 2005, 2.6x. So … Starbucks is catching up! (Of course, the recession intervened, as did laws against predatory lending: the 2010 data may be less compelling.)

In short, one could readily take the same data, cook up a different chart and suggest different conclusions. At the end of the day, I agree with @Onder and @Matth wrt the class divide, but the comparison here (however charted) does little for me. Sadly, all I need to see is the red line.

What I find more startling than the growth of payday lenders is the astounding growth of banks that lend generously to plaintiffs to bring class action suits – not individual cases because that wouldn’t be enough profit. It’s a hugh business now and costs us all as the prices get absorbed by consumers. It seems just ugly bottom-feeding. As if we don’t have enough litigation.

Makes sense, since concentrations of wealth at the same time were headed in opposite directions. During the same period, we had more rich and more poor, and these two services cater to each group.

Count me among those whose first instinct is to see an acceleration of class divide here.

Those who frequent payday lenders are getting more and more squeezed, thus jamming up volume for last-in-line lending.

Those who frequent Starbucks are the ones making it out of the recession, or who perhaps never felt it, and continue to be around to support the expansion of a high-disposable income segment.

I’m sure that’s a pretty crude reading of the data, but I must say it strikes as a far more realistic interpretation than the idea that a homogeneous population is behaving irrationally. I see two distinct populations, each behaving very rationally–just that one’s got, and one’s not.

I agree totally with Onder Kustu, the line between the “haves” and “have nots” is getting very big.

Behavioral econmics is being studied relative to a closed system — meaning if I worked at X corp and they wanted me to eat healthy, they could price healthy options at lower cost and then reward my behavior for purchasing X times – does that change into new, sustainable behavior? To my knowledge, data does not exist yet.

While most of us would agree that payday loan growth at least appears to prey on the economically weak, let’s take a step back and look at Starbucks’ growth as a comparable business phenomenon.

First of all, did people drink coffee prior to the arrival of Starbucks? Yes. Did people borrow money from unscrupulous lenders prior to the advent of payday lenders? Yes.

Did Starbucks gain market share at the expense of traditional coffee outlets (diners, McDonalds, our own kitchen coffee pots)? Yes. Did payday lenders gain market share at the expense of Guido, friends, family and co-workers? Yes, quite likely.

What we cannot tell from the data provided is whether more Americans are drinking coffee now than in 1990 nor can we tell if more Americans are borrowing money paycheck to paycheck.

Some might ask why any rational adult would pay usury rates to borrow from a stranger when these other sources provided such loans in the past. A couple of thoughts: pride (in the case of borrowing from family, friends and co-workers) and safety (in the case of Guido).

The sad part of all of this is that the new banking regulations are pushing low margin customers out of the world of legitimate banking. And payday lenders are answering the call with such conveniences as deposit accounts and debit cards. And once in the door, its only a matter of time before the “convenience” of short term loans available where these folks “bank” will turn these customers into payday loan borrowers. If you don’t believe it will happen you might want to look into the recruiting of Chase and Bank of America consumer loan officers by Pawn America and others.